Digital banking FAQs.

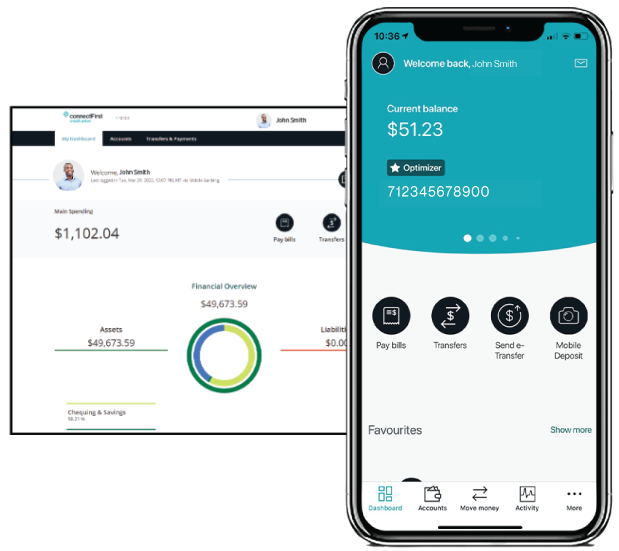

Banking on a browser and mobile app.

Not sure how to perform certain transactions, trying to personalize your experience or find that you're locked out of your account? We have you covered with some frequently asked questions to help guide you.

FAQs ➜System and service status.

For digital banking, ATMs, and Point of Sale.

Check here for the operating status of digital banking, ATMs and point of sale, including scheduled system maintenance and update alerts so that you're always prepared and informed.

Learn more ➜Digital Banking Security.

Your information is safe with us.

Truth be told, our digital banking platform is safe and secure and provides the best security available to protect the privacy of our members' accounts and information.

Learn more ➜Open a new account.

Quick and easy account opening.

Existing members can open a new chequing or saving account within minutes through their online banking. Log in via browser or mobile app to get started or click here to learn more.

Login ➜Digital banking video guides.

Bill payments.

Transfer funds.

Bill payments.

Transfer funds.

Some things worth talking about.

A new look for your Interac® e-Transfer notifications.

On October 22, Interac is refreshing the design look and feel on all email notifications, including:

- Receive and send notifications

- Autodeposit send, receive and registration notifications

- Request money notifications

No action is needed on your part

You don't need to do anything differently. Your settings, including Autodeposit, won’t change, and you can send and receive money as you always do. You will continue to enjoy the same security and convenience when sending and receiving funds.

You can help keep your financial activity secure

Although nothing is changing with how you send and receive money using Interac, you have an important role to play in protecting your accounts. Here are some ways to ensure your online and mobile banking is as secure as possible:

- Set up Interac e-Transfer Autodeposit for ease, added security and so you never need to click on a link to accept a transfer. You can set up Autodeposit in online or mobile banking.

- Sign in to your online banking from your trusted device to verify a deposit.

- If you don’t have Interac e-Transfer Autodeposit set up, always use a strong e-Transfer password that can’t easily be guessed or found, and make sure you share it through a safe channel.

- Sign up for Two-factor Authentication.

- Sign up for Security and Transaction alerts on your accounts through your online or mobile banking.

Ensure the e-Transfer notification you receive is actually from Interac.

Interac is a safe and secure method to send and receive money, but it's important to ensure the notifications are actually from Interac.

- If you receive an Interac e-Transfer text or email you weren’t expecting from someone you know, don't reply to the email or text. Contact them using another channel to confirm they sent the request.

- Incoming Interac e-Transfer emails are sent from "notify@payments.interac.ca" and texts come from "100001.”

- If you don’t have Interac e-Transfer Autodeposit set up, always use a strong e-Transfer password that can’t easily be guessed or found, and make sure you share it through a safe channel.

- Interac does not use QR Codes as a payment method.

- If you don’t recognize the sender and you suspect that the email notification that you have received is fraudulent or a phishing attempt, do not click on any links.

- If you have clicked on a QR code or any other e-Transfer notification not from Interac, notify our Member Contact Center at 1.866.923.4778 right away to advise us and protect your accounts.

Telephone Banking.

Our telephone banking service is longer available as of September 10, 2024. To continue managing your accounts securely and conveniently, please use:

- Online Banking: View our video guides, brochures or FAQs on how to get started.

- Member Connection Centre: Call 1-866-923-4778.

- Branch Services: Visit your nearest branch.

Talk to us

Search

Search

Learn

Learn