Everyone has debt. Well, mostly everyone. So don’t feel ashamed. Credit Canada indicates that the average consumer in Canada has around $20,739 in debt.And like others you may be feeling overwhelmed with how to pay it back. Trying to pay down interest and principal to each of your debts might be running your budget off the rails.

Here’s what we’re going to cover:

- Put all of your debts on the table: get a clear picture of what you owe, what interest you pay, and what your minimum payments are and when they’re due.

- How to calculate interest

- How to pay off debt in logistical order

Hint: pay your biggest interest payment debt first - How to manage unmanageable debt

1. All Your Debts on the Table

Grab a piece of paper. Turn it so it’s landscape oriented. Get a crayon, a marker, a gel pen or whatever is fun for you to write with. Or just a regular pen or if you’re more business.

Now go fetch all the debt information you have. Credit cards, loans, lines of credit, etc.

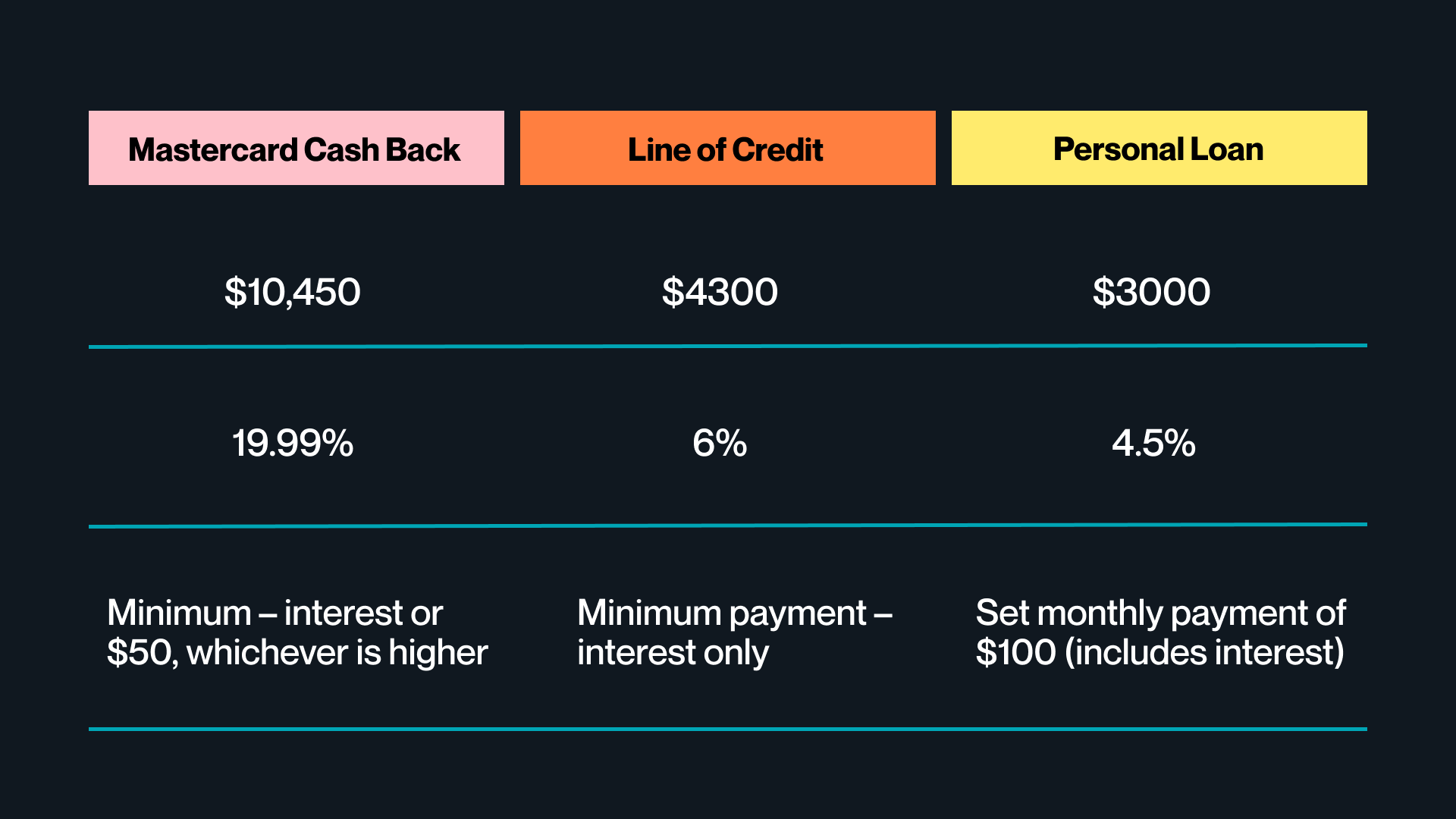

Make a column for each of your debts. Write how much you owe, what the interest rate is, and your minimum monthly payments, if one is set. Minimum payments are typically interest payments. You can find your minimum payments on your statements. It should look like this when you’re done:

It’s worth noting that debt vehicles such as government student loans are set at such a low interest rate, that it might be worth skipping them and paying them off on the schedule that’s already been created. In the end, the cost to you in interest is not near as much as credit cards or lines of credit.

2. How to Calculate Interest

This step is important, so don’t skip it! The reason we want to know the interest accumulating on your debts is so we know which one is the most expensive so we can focus on paying that one down first.

A note before we continue: some credit facilities are deceptively less or more in interest. You’ll need to consider things like grace periods and compounding interest to better understand what you’re paying on your facilities. If it isn’t clear by looking at a statement, a quick call to your bank or credit union should help clear it up.

If you failed math in high school don’t worry, we’ll outline the formula for you so all you have to do is plug it in on a calculator. The formula is:

(principal)(interest)=X

Divide X by 12.

Divide X by 12.

To spell it out, multiply the interest rate and the amount you owe. That will give you X. Divide X by 12. This represents 12 months. Interest rates are typically annual interest rates, which is why we divide that number.

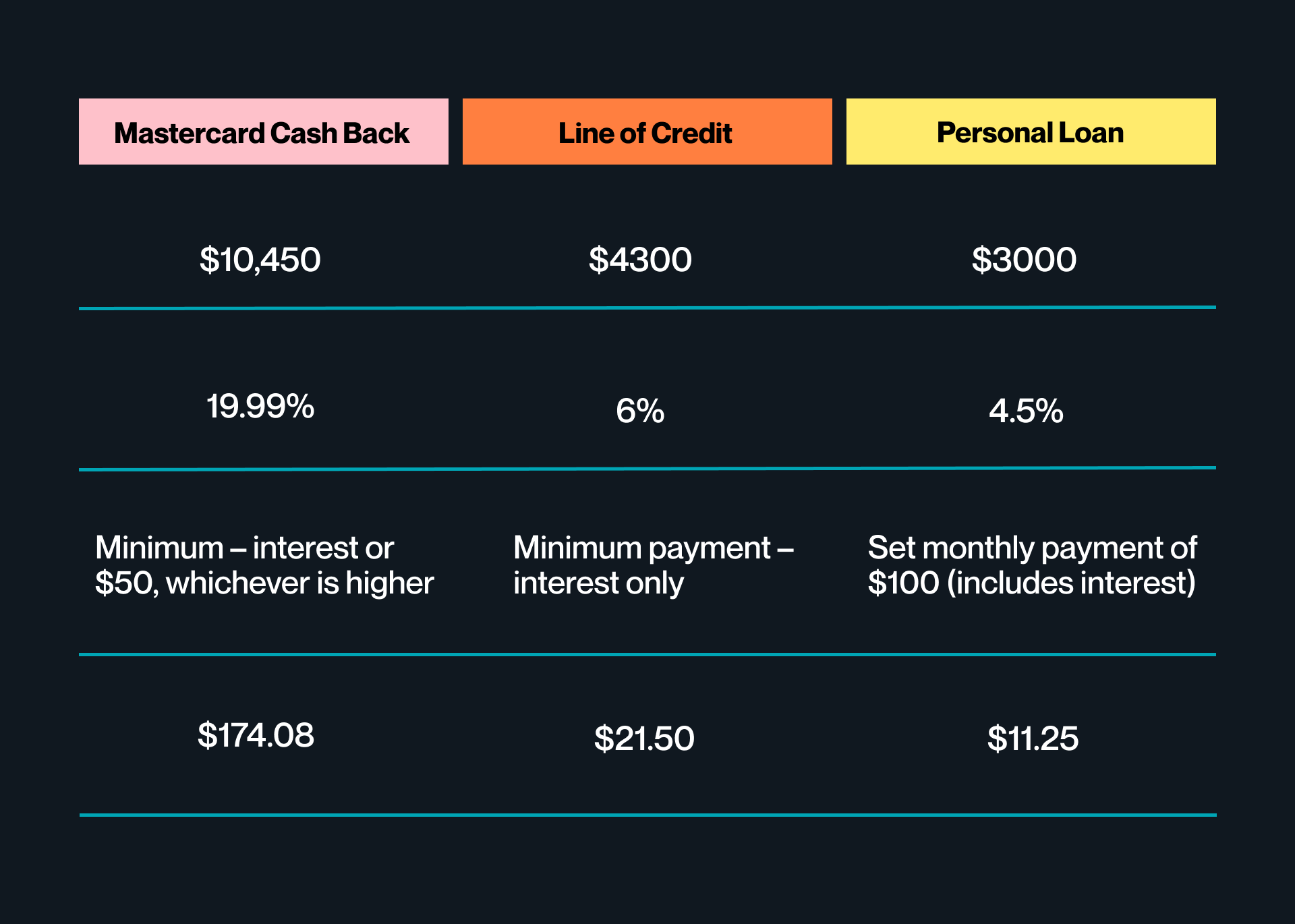

Here’s an example:

So this means that each month you are likely paying around $174.08 in interest on this loan. Keep in mind this number might be slightly different depending on what sort of payments you’ve made recently, etc, but it will give you an idea of roughly where you’re at.

3. Pay Off Your Debt in the Most Logical Way

Take a different color crayon, marker, or pen and number your most expensive debt to least expensive. For example:

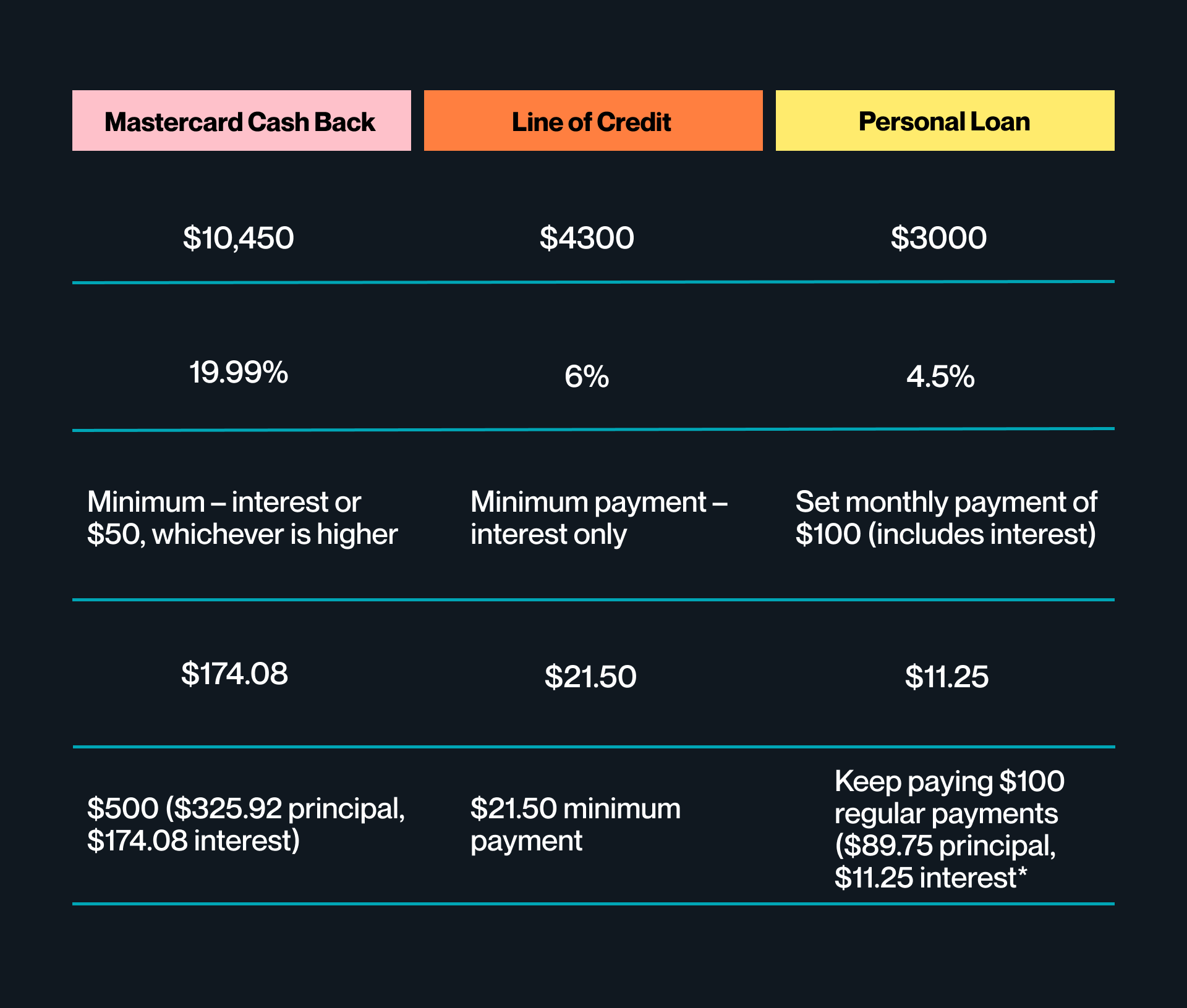

You’re going to start with the one with the highest amount of interest charged to you per month, meanwhile satisfying only minimum payments to the other debts.

You may have a situation where you pay, for example, a car loan that has a fixed monthly payments of $400. Continue to pay that as you have been. These payments are not typically flexible since it is a term loan, meaning it’s only meant to last for a certain period of time i.e. five years. The same example is pictured above with the person loan – there’s a set monthly payment that you can stick with until you have a lump sum that you can apply, if you choose to do so.

But for payments that are flexible, such as credit cards and lines of credit, you can reduce your payments to those and turn your budget to, again, the most expensive piece of debt that you have.

The idea is to pay off that most expensive one first so that you don’t accumulate more debt by accumulating more interest. Make sense?

So your payments might look something like this:

*Another note: the more you pay down on these facilities, the less your interest will be. So this is the starting point, but for the next few payments you’ll notice that the interest your paying will go down because you’re taking away from the principal amount owing.

4. Managing the Unmanageable

If this process has made you feel more overwhelmed, then maybe it’s time to change your debt situation.

A way to check your stress meter is to check your TDSR which stands for Total Debt Servicing Ratio. This is basically the ratio of debt payments vs income. If your debt ratio is higher than 44% it’s reasonable to assume you are feeling stressed.

Say the interest accumulating on your credit card is running away from you and you’re having a hard time keeping up with payments, it might be time to consider a consolidation loan. This type of loan takes your existing individual debts and compiles them into one lower interest term loan. This makes your interest paid a lot lower and payments more manageable, because it’s all in one place.

If your debt is so large that a consolidation loan isn’t possible then there are two options that sound scary, and certainly have consequences, but may be a way for you to reset.

Consumer proposal

When you work with a financial advisor or debt counselor to create a consumer proposal, you are essentially asking your debtors if you can pay a portion (essentially, what you can afford) of the debt. For instance, if you owe $70,000 in credit card debt you might be able to offer them $20,000.

The benefit of a consumer proposal is that you won’t be prevented from applying for credit products in the future, however, it will negatively impact your credit score, and is not a decision to be taken lightly. It will show up on your bureau and will state the status of “paid,” “settled,” or “closed.”

Bankruptcy

Bankruptcy is a different beast. A bankruptcy trustee submits your income to the courts to determine what your surplus income is each month. From there, it’s determined how much per month will go towards your bankruptcy. The length of bankruptcy is determined by the amount of surplus income you have. In addition, you may have assets, such as a car, seized and sold to pay down your obligations.

The consequences of filing bankruptcy is that it will remain on your credit report for 7 years past your discharge of bankruptcy. You will be impacted in your ability to be approved and the rates you will be offered for credit products in this time frame. Your credit options will be limited until you are past the 7 years from discharge and have spent some time re-building your credit.

There’s no shame in any of these options. Managing credit and debt isn’t always easy and life situations sometimes make it hard to avoid getting into a troublesome place.

If you want more information and guidance about what option is right for you book an appointment with one of our advisors today.

Remember that you don’t have to keep a credit card that isn’t serving you. You have options to get into a line of credit or loan that will cost you less in interest. And we’d love to have that conversation with you. We’re not here to judge, we’re here to help.

Search

Search

Learn

Learn